We Are Never Getting Back Together Canada Downloads 55,000

Alternate formats

Request other formats online or call 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105. Large print, braille, audio cassette, audio CD, e-text diskette, e-text CD and DAISY are available on demand.

Since Prime Minister Justin Trudeau gave me the mandate to develop Canada's first-ever national poverty reduction strategy two and a half years ago, I have been fortunate to meet with and hear from thousands and thousands of Canadians from coast to coast to coast. Through roundtables and town halls, in person and online, via conversations and conferences, I have heard diverse experiences and insights on how we can understand and reduce poverty in this country.

The range of voices we heard during our consultation process allowed us to get a better understanding of poverty and ways to reduce it. We heard from and engaged with other orders of government - from provinces, territories and municipalities - as well as from our First Nations, Inuit and Métis partners. We heard from members of my advisory committee, drawn from Canada's incredible range of social, cultural and economic backgrounds. We heard from academics and researchers. We heard from people working on the front lines of tackling poverty. Most importantly, we heard from Canadians with lived experiences of poverty.

These Canadians spoke of the importance of providing opportunity for all; they spoke about dignity, inclusion, security, resilience and empowerment; and they spoke about the damages of "us versus them" attitudes, language and policies.

It is my great honour and privilege to take the stories, concerns and accomplishments that Canadians shared with us and use them as the basis for developing a strategy that reflects the fundamental needs and the highest aspirations of all Canadians—a strategy built on the same pillars that enable our middle class to succeed:

Canada's first-ever Poverty Reduction Strategy is built on the vision that whoever they are, and wherever they originally came from, all Canadians should be able to live in dignity. Canada's first-ever poverty reduction strategy is built on the belief that all Canadians deserve to be treated fairly and to have the means and the abilities to grow and fully participate in the development of their communities. And Canada's first-ever poverty reduction strategy is built on the vision that all Canadians should have a sense of security and be hopeful that tomorrow will be better than today for them, for their loved ones and for the generations to come.

To be effective, Canada's Poverty Reduction Strategy must have transparent indicators, clear targets and tangible actions. That is why Canada's Poverty Reduction Strategy is introducing, for the first time ever, an official poverty line for Canada, as well as targets to reduce poverty by 20% by 2020 and 50% by 2030 based on the official measure of poverty. The Strategy also introduces a set of indicators to measure and monitor meaningful dimensions of poverty and inclusion. Canada's Poverty Reduction Strategy also supports data sharing, knowledge creation and engagement with Canadians, in part by establishing a National Advisory Council on Poverty, enshrined into law.

Taken together, this vision and these actions will help ensure that Canada's first-ever Poverty Reduction Strategy provides all Canadians with a real and fair chance to succeed.

In one sense, it is surely actions taken, programs designed, monies spent. And that is how this document begins: a list of policies, programs and budgets that the government has undertaken, and for which politicians want to be given credit. The federal government can rightly claim that it has been pursuing a "poverty reduction strategy" from the day it was elected in October 2015.

But for citizens, whether poor, rich or middle class, this is not good enough. A poverty reduction strategy must also be a clearly stated set of priorities that reflect our concerns; priorities that are paired with measurable targets allowing us to plot a path to somewhere better. This collection of targets, timelines, and indicators is also a "poverty reduction strategy" because it gives citizens a way to hold governments to account, to focus attention not just on money spent---our money after all---but also on the connection between actions and outcomes. Credit is due, not when budgets are spent, but when outcomes we care about are efficiently and effectively achieved.

This document also offers a strategy in this sense. It defines for the first time an official indicator of poverty, setting clear targets and timelines to lower the fraction of Canadians living in poverty, and offering three sets of complementary signposts recognizing that poverty is about more than just money.

I am an outsider who was invited inside: a professor at the University of Ottawa given the opportunity to work in the Deputy Minister's office during 2017 as the Economist in Residence, and as a member of the team of public servants supporting Minister Duclos's efforts in building Canada's first official Poverty Reduction Strategy.

In my life as an academic, I have developed a great respect for the ideas of the Nobel Prize winning economist Amartya Sen. One of Professor Sen's more influential books is called "Development as Freedom," and I believe he used the word "development" in two ways: to refer to economic growth and prosperity, but also to refer to personal growth and well-being.

We "develop" as individuals and citizens when we have the freedom to choose the life we value.

This, it seems to me, is the task to which Canadians expect their political leaders to be devoted: to listen to the projects that citizens hold dear, to recognize the barriers they face and to work hard toward lightening this load, removing those barriers and developing their freedom to choose.

In my year as a public servant, I witnessed a process of unparalleled consultation across the country, with communities and front-lines workers, with stakeholders and researchers, and most importantly with citizens who have lived in poverty, who have escaped it or who feel insecure as a result of it.

The Minister clearly fostered the opportunity to hear the projects and concerns citizens hold dear. What they told him gives Canada's Poverty Reduction Strategy its purpose.

This cannot be just about numbers, indicators, targets: whether or not Statistics Canada tells us that some statistic took an uptick or a dip a year and a half ago? Whether a certain percentage of 15 year olds pass some sort of literacy test? Or whether a young household has put a bit of money aside?

Rather, it is about whether Canadians have the resources, monetary or otherwise, to live life with dignity and to participate normally in society; about whether the young have a solid education that will open doors for them; about whether those doors are open free of discrimination so that everyone's skills and talents are recognized; about whether families are confident about the future, knowing they can deal with the challenges that tomorrow will surely bring.

Dignity, opportunity, resilience.

These three words summarize the concerns the Minister heard. They reflect the moral purpose that motivates a poverty reduction strategy, that underlies the indicators and targets, and that ultimately makes the strategy useful.

But Canada's Poverty Reduction Strategy will prove its use with time, it will have staying power if the same spirit of consultation continues and fosters both a sense of ownership among Canadians, and an ongoing sense of urgency among this and future governments. Our politicians will need to continue listening, and we will need to continue voicing our concerns using the measuring rods in this document, but also continually refining and adapting them to better reflect what it means to fully participate in an ever-changing Canadian community.

Miles Corak

Economist in Residence, 2017

Employment and Social Development Canada

Canada is a prosperous country, yet in 2015 roughly 1 in 8 Canadians lived in poverty. The vision of Opportunity for All – Canada's First Poverty Reduction Strategy is a Canada without poverty, because we all suffer when our fellow citizens are left behind. We are all in this together, from governments, to community organizations, to the private sector, to all Canadians who are working hard each and every day to provide for themselves and their families.

The Government is committed to poverty reduction and did not wait to release a poverty reduction strategy before taking action. For example, the new Canada Child Benefit gives more money to families who need it most to help with the cost of raising children. The increase to the Guaranteed Income Supplement ensures more seniors can retire in security and dignity. And, starting in 2019, the new Canada Workers Benefit will help Canadians take home more money while they work hard to join the middle class.

The Government has also made longer-term investments in areas such as housing, clean water, health, transportation, early learning and child care, and skills and employment, which will help address multiple dimensions of poverty.

Overall, Opportunity for All brings together new investments of $22 billion that the Government has made since 2015 to support the social and economic well-being of all Canadians. These actions will help lift about 650,000 Canadians out of poverty by 2019, with more expected as the impacts of these investments are realized in the years to come.

Opportunity for All also sets the foundation for future government investments in poverty reduction. It is based on three pillars to focus government actions to reduce poverty:

Opportunity for All sets, for the first time, ambitious and concrete poverty reduction targets: a 20% reduction in poverty by 2020 and a 50% reduction in poverty by 2030, which, relative to 2015 levels, will lead to the lowest poverty rate in Canada's history.

Through Opportunity for All, we are putting in place a National Advisory Council on Poverty to advise the Minister of Families, Children and Social Development on poverty reduction and to publicly report, in each year, on the progress that has been made toward poverty reduction.

The Government also proposes to introduce the first Poverty Reduction Act in Parliament in Canada's history. This Act would entrench the targets, Canada's Official Poverty Line, and the Advisory Council into legislation.

Opportunity for All is a whole-of-government strategy that involves actions and investments that span across the federal government. However, the Government recognizes that to be successful, it cannot act alone. Partnerships will be important. The Government will work closely with provinces, territories, and municipalities, and will forge strong bonds with Indigenous peoples, stakeholders, charities and community groups on the front lines of tackling poverty in communities across Canada, to ensure our programs and policies are aligned and complementary, as Canadians expect and deserve nothing less. And, finally, the Government will continue to reach out to all Canadians who all have a stake in Opportunity for All, particularly those who live in poverty.

The Government will continually track and make improvements to how poverty is measured. Progress will therefore be measured against, and future decisions will be informed by, evidence that is based on the highest statistical standards, building on the Prime Minister's leadership and the commitment G7 leaders made this year to measure growth that works for everyone.

The Government will advance the dialogue with Canadians from all corners of the country, so we can continue to build a Canada without poverty.

Opportunity for All will help reduce poverty, support Canadians working hard to join the middle class and build a diverse, prosperous and truly inclusive country where everyone benefits from economic growth—a country where all Canadians can realize their full potential.

Poverty is:

The condition of a person who is deprived of the resources, means, choices and power necessary to acquire and maintain a basic level of living standards and to facilitate integration and participation in society.

Canadians have long been ambitious about reducing poverty. Channelling this ambition, Opportunity for All – Canada's First Poverty Reduction Strategy, sets a bold vision for Canada as a world leader in the eradication of poverty: a vision for a Canada without poverty.

While there are many definitions of poverty, it can be understood as the condition of a person who is deprived of the resources, means, choices and power necessary to acquire and maintain a basic level of living standards and to facilitate integration and participation in society.

While some Canadians may be more vulnerable to poverty than others, no one is immune. Some individuals work two or three jobs but still live on a low income. Others are working hard to get ahead but face individual, structural, and systemic barriers, including discrimination.

And some Canadians have joined the middle class but might lack the resources needed to make it through life's setbacks, such as a job loss, sudden illness or family trauma.

While poverty affects everyone differently, when some Canadians are left behind, all Canadians are impacted. Poverty affects the strength and resilience of our communities. People living in poverty are more likely to face health-related setbacks, to have difficulty finding and keeping a job, to find themselves in the criminal justice system, and to need various social supports and assistance. Also, children who grow up in poverty are more likely to remain in poverty as they age.

In a country as wealthy as Canada, we cannot stand by while our fellow citizens struggle. By working to reduce poverty, Canada will promote economic growth, foster community and help more Canadians join the middle class.

Opportunity for All is about working together to end poverty so that all Canadians can live with dignity, have real and fair access to opportunities to succeed, and be resilient enough to get through difficult times. Living with dignity means that Canadians would be living without hunger and would have enough income to meet their basic needs; having access to opportunities means that Canadians would be able to move out of poverty and acquire the skills, education and jobs they need to be at their best; and being resilient means Canadians would have the income security and social supports they need to rebound from life's setbacks.

Canada's first Poverty Reduction Strategy offers an inspiring vision, while also recognizing that mere vision is not enough. The Strategy sets, for the first time ever, an official poverty line for Canada as well as concrete targets for poverty reduction that are intended to become the law of the land. It also sets out specific indicators that will be used to monitor progress toward a country that we all want: a Canada in which hard work allows families to be better off; a Canada where everyone is treated fairly; a Canada in which all children can grow up to become all they can be; and a Canada in which seniors are secure, valued and living in dignity.

In creating this Strategy, the Government has looked at and learned from examples from coast to coast to coast: from Indigenous peoples, from provinces and territories, and from cities like Edmonton, Toronto, Saint John and the many other municipalities across Canada that have poverty reduction strategies in place offering ambitious goals and indicators to measure progress. The Government has looked beyond Canada's borders as well, to learn from what other countries have done to better understand and reduce poverty. The Government has also worked with stakeholders, community leaders and organizations, and businesses. Perhaps most importantly, the Government has listened to Canadians living in poverty or with lived experience of poverty and working hard to provide for themselves and their families.

Opportunity for All is guided by the thousands of voices we have heard and, in particular, the voices of those with lived experience of poverty. Canadians told us that poverty is complex, that different groups experience different risks of poverty and different challenges in getting out of poverty, and that reducing it requires a long-term commitment as well as calls for a coordinated approach with diverse groups—government and non-government alike. Canadians told us that the Strategy must contribute to a national effort to reduce poverty. It must also recognize that when some members of our communities cannot reach their full potential, we are all affected.

More specifically, Canadians have said that the Poverty Reduction Strategy should be about:

For the first time in our country's history, the Government will set an official measure of poverty.

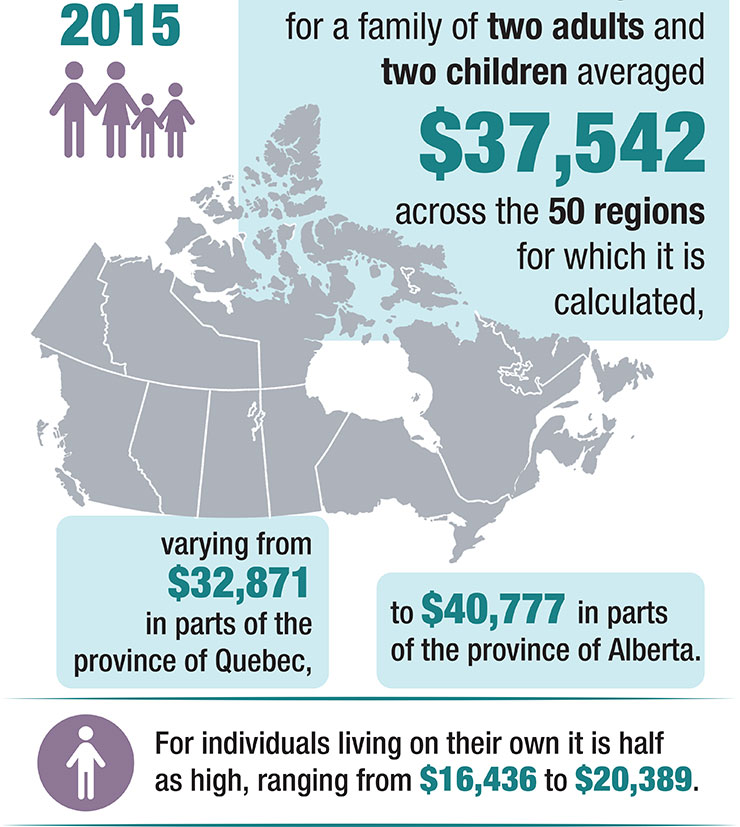

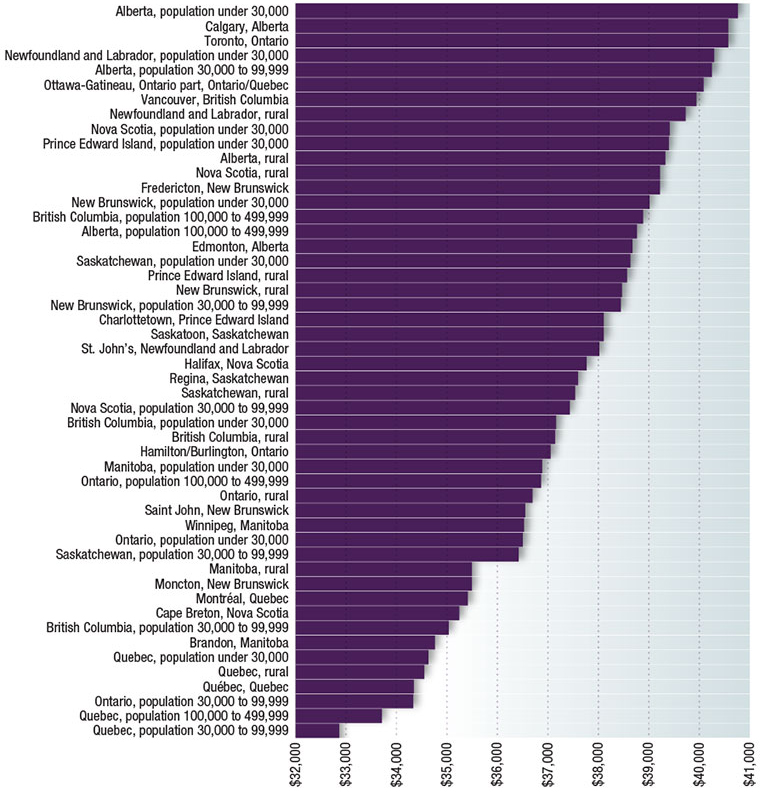

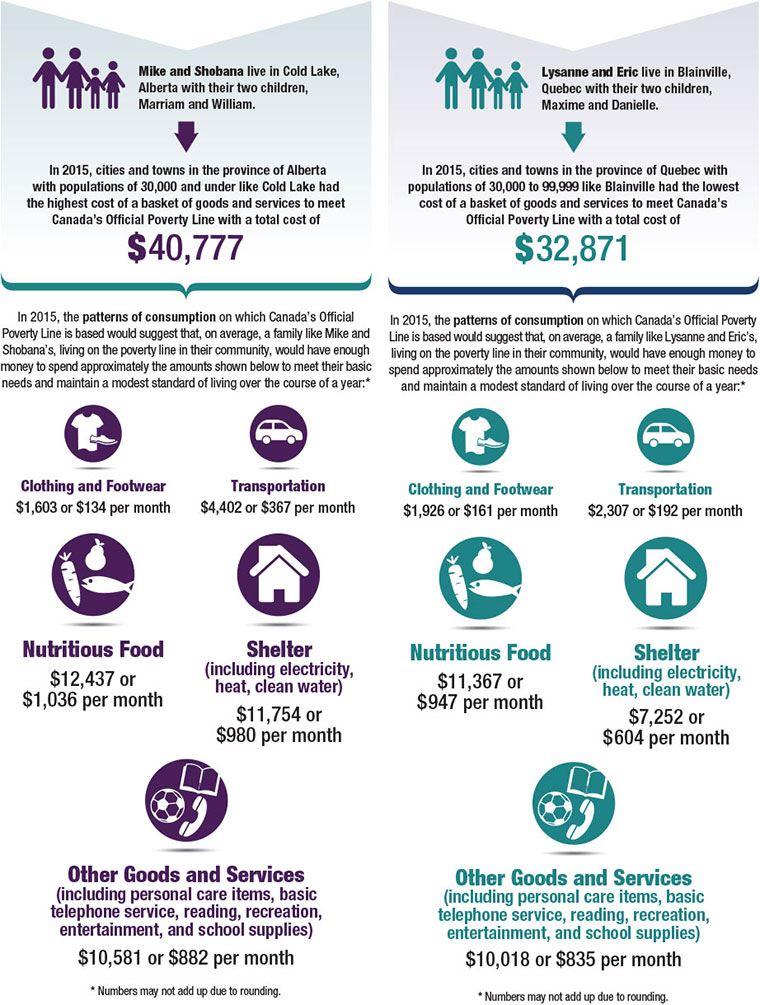

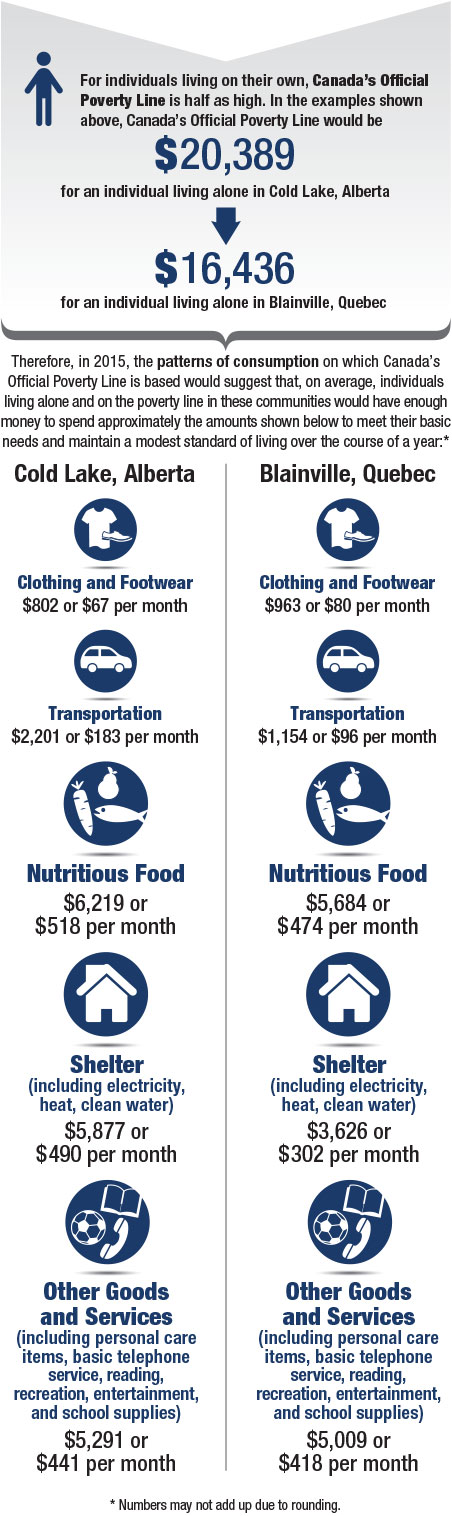

Canada's Official Poverty Line will be calculated using what is currently known as the Market Basket Measure. Canada's Official Poverty Line reflects the combined costs of a basket of goods and services that individuals and families require to meet their basic needs and achieve a modest standard of living. The basket includes items such as healthy food, appropriate shelter and home maintenance, and clothing and transportation. It also includes other goods and services that permit engagement in the community, particularly for children, youth, parents and seniors.

The cost of each item in the basket is directly linked to the prices of these items in communities across Canada. Canada's Official Poverty Line reflects poverty thresholds for 50 different regions across the country, including 19 specific communities. Wherever individuals and families are living across the country, if they cannot afford the cost of this basket of goods and services in their particular community, they are considered to be living below Canada's Official Poverty Line—that is, living in poverty. Statistics Canada will update the basket to reflect the reality of what is needed to participate in society today and going forward, with further updates taking place on a regular basis.

For the first time in Canada's history, the Government will set measurable targets for poverty reduction. The Government intends to entrench these targets in legislation.

Specifically, Canada's Official Poverty Line will be used to measure progress toward two ambitious but realistic targets:

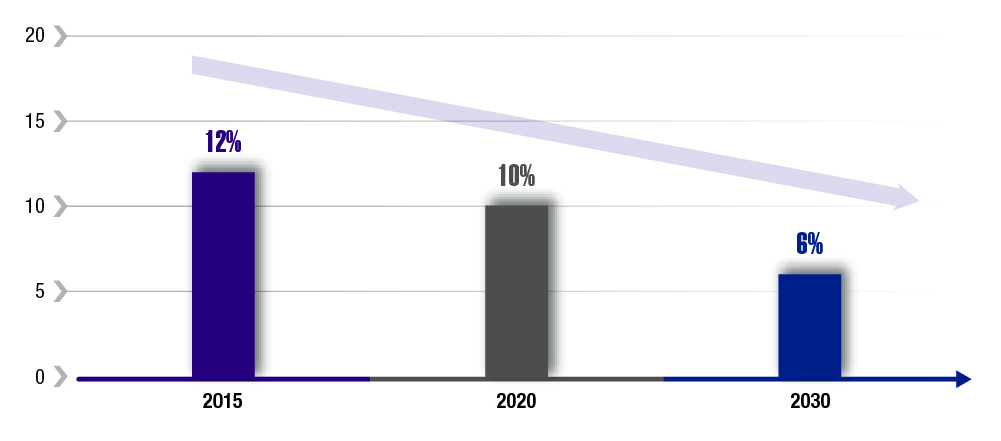

In 2015, 1 in every 8 Canadians (about 12%) lived in poverty. Meeting these targets will mark a significant reduction in poverty in our country, reducing the number of Canadians living in poverty to 1 in 10 (about 10%) by 2020, and to 1 in 17 by 2030 (a target of 6%).

We are already working hard to meet these ambitious targets.

Since 2015, the Government has invested in the social and economic well-being of Canadians. For example:

Indeed, this government's actions will help lift about 650,000 Canadians out of poverty by 2019, with more expected as the impacts of these investments are realized in the years to come. The Government has also made longer-term investments in areas such as housing, clean water, health, transportation, early learning and child care, and skills and employment, which will help reduce the incidence of other dimensions of poverty.

Text description

Reducing poverty rate from 12% in 2015 to 10% in 2020 and 6% in 2030.

For our objectives to be achieved, the journey to achieving them must be guided by meaningful, measurable and monitorable indicators. Progress will be tracked not only by measuring the poverty rate based on Canada's Official Poverty Line, but also by using a dashboard of other indicators, which will be made available online so Canadians can track progress in poverty reduction.

Opportunity for All also invests in Canada's statistical infrastructure to make all of these indicators more useful, reliable and detailed in their coverage, and of a quality that aligns with the highest standards.

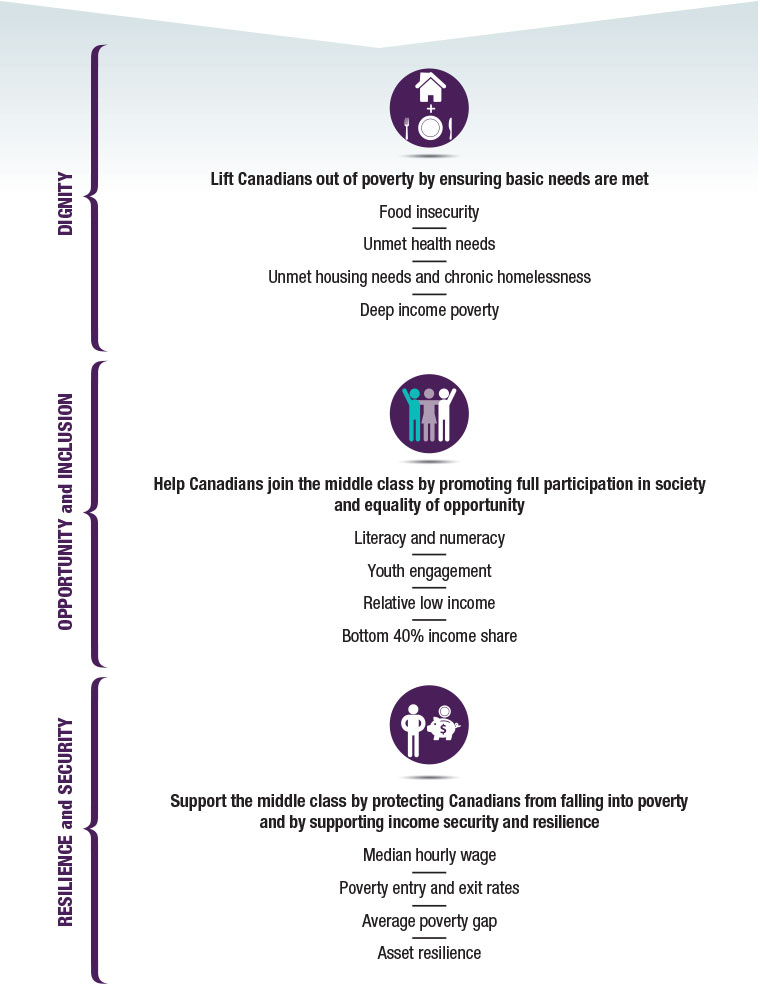

Text description

Dignity: Lift Canadians out of poverty by ensuring basic needs are met

- Food insecurity

- Unmet health needs

- Unmet housing needs and chronic homelessness

- Deep income poverty

Opportunity and inclusion: Help Canadians join the middle class by promoting full participation in society and equality of opportunity

- Literacy and numeracy

- Youth engagement

- Relative low income

- Bottom 40% income share

Resilience and security: Support the middle class by protecting Canadians from falling into poverty and by supporting income security and resilience

- Median hourly wage

- Poverty entry and exit rates

- Average poverty gap

- Asset resilience

To ensure accountability to Canadians, the Government is establishing a National Advisory Council on Poverty with a mandate to both advise the Government on poverty reduction and to report publicly to Parliament and Canadians on the progress it has made toward meeting the targets every year. As part of its role, the Advisory Council will also foster a national dialogue on poverty reduction.

To cement the Government's commitment to reducing poverty, the Government proposes to introduce a new Poverty Reduction Act in Parliament. The Act would make Canada's Official Poverty Line and the poverty reduction targets the law of the land. The Act would also enshrine the Advisory Council in legislation so that poverty reduction would remain a priority for all governments into the future.

To be successful, the Government cannot act alone. The Ministerial Advisory Committee on Poverty has been instrumental in helping the Government develop a Strategy that reflects the views of all Canadians, in particular those with a lived experience of poverty. Moving forward, partnerships will continue to be important. The Government will work closely with provinces, territories and municipalities, and will forge strong bonds with Indigenous peoples, stakeholders, charities and community groups on the front lines of tackling poverty in communities across Canada, to ensure our programs and policies are aligned and complementary, as Canadians expect and deserve nothing less. As tackling poverty is a shared responsibility, the Government is also inviting the private sector—businesses large and small—to do its part. We are all in this together, and we are all better off when no one is left to struggle alone.

The Government will continue to work in partnership with Indigenous organizations to realize a Canada where we have achieved meaningful reconciliation with First Nations, Inuit and Métis. As part of Opportunity for All, this will mean recognizing the unique understanding and experience of poverty amongst Indigenous peoples, supporting autonomy and empowerment, and building on investments to date that take a distinctions-based approach, where programming is designed with and for Indigenous peoples.

Opportunity for All also engages Canada with the world. Our targets and indicators are reflected in the United Nations Sustainable Development Goals for 2030. This is further evidence that we are on the right path.

Canada was one of 150 countries to adopt a set of goals to end poverty, protect the planet and ensure prosperity for all as part of a new sustainable development agenda. Each of the 17 goals has specific targets to be achieved by 2030. Canada's longer-term target set out in Opportunity for All—to reduce poverty by 50% by 2030—reflects our commitment to the first Sustainable Development Goal: "By 2030, reduce at least by half the proportion of men, women and children of all ages living in poverty in all its dimensions according to national definitions." Meeting this target will help fulfill the vision of Canada as a world leader in poverty reduction.

In addition, 6 other Sustainable Development Goals are aligned with and support the indicators, beyond income, that Opportunity for All will use to monitor progress toward reducing poverty. These goals relate to food security; health and well-being; quality education; gender equality; inclusive and sustainable economic growth, employment and decent work; and reduced inequalities. Opportunity for All supports these goals and reflects their spirit and intent.

The vision of Opportunity for All is to eradicate poverty because we are all better off when no one is left behind. Opportunity for All supports a human rights-based approach to poverty reduction, reflecting principles that include universality, non-discrimination and equality, participation of those living in poverty, accountability and working together. This is done by consulting people with lived experience of poverty in the development and implementation of the Strategy, establishing measurable targets and timelines, ensuring accountability through an independent National Advisory Council on Poverty and proposing legislation to ensure poverty reduction remains a priority well into the future.

Opportunity for All will help reduce poverty, support Canadians working hard to join the middle class and build a diverse, prosperous and truly inclusive country—a country where all Canadians can realize their full potential.

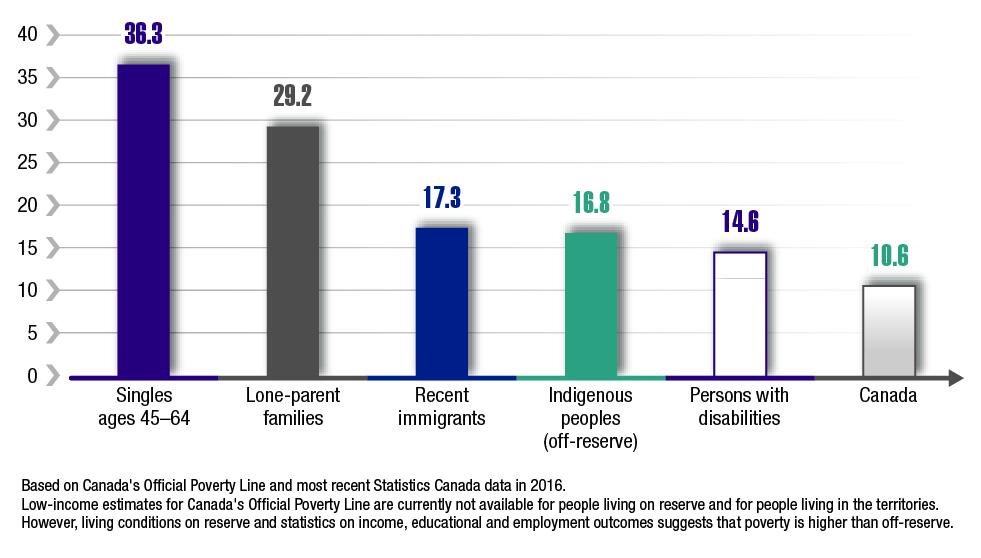

The Strategy is guided by an understanding of the complex nature of poverty, recognizing that, for many reasons, some groups of Canadians are more at risk of poverty. The Strategy aims to remove barriers that prevent these groups from moving up, so they can be at their best. In particular, these groups include Indigenous peoples, singles aged 45-64, Canadians with disabilities, single parents (most of whom are women), seniors, recent immigrants, Black Canadians and individuals from other racialized communities, LGBTQ2 (in particular transgender individuals) and Canadians with significant health issues.

The Strategy also ensures that actions taken by the Government will be meaningful to Canadians based on what they have told us is important, measurable so that we will know if we are making progress and monitored so that the Government is held accountable for its commitment to reducing poverty. With measurable indicators and meaningful targets that will serve to monitor progress, the Strategy will guide Canada towards our vision of a country without poverty.

Poverty is:

The condition of a person who is deprived of the resources, means, choices and power necessary to acquire and maintain a basic level of living standards and to facilitate integration and participation in society.

The Government is focused on growth that benefits everyone, and on investments that help grow the middle class and reduce poverty. Some of these investments, like the Canada Child Benefit and the increase to the Guaranteed Income Supplement, are having immediate impacts on reducing poverty and making a difference in the lives of Canadians. Other actions by the Government, such as historic investments in early learning and child care, the National Housing Strategy, public transit infrastructure, and home care and mental health, are laying the foundation for changing the lives of Canadians in the years to come.

This government has made—and continues to make—significant investments in support of poverty reduction. This year, the Government is projected to invest nearly $10 billion in new spending in support of poverty reduction, including investments through the Canada Child Benefit, the increase to the Guaranteed Income Supplement and the National Housing Strategy. This builds on new investments in poverty reduction this government has already made totalling $5 billion in 2016-17 and nearly $7.5 billion in 2017-18. Total investments over the 2016-17 to 2018-19 period are $22 billion, and the Government has also committed new investments of over $12 billion for 2019-20. These investments will help Canada meet its official poverty reduction targets and make measurable progress toward social and economic well-being for all Canadians.

The first pillar of Opportunity for All is making sure that Canadians have the basic necessities to live life with dignity. We have made significant and immediate investments in this pillar, especially for children, seniors, and lower-wage workers.

Lifting children out of poverty is a top priority. Evidence shows that children who grow up in poverty are more likely to remain poor as they age. Recognizing this, the Government has bolstered benefits to families with children through the new, more generous, tax-free Canada Child Benefit. The Canada Child Benefit is helping lift hundreds of thousands of children out of poverty, and has improved the quality of life for hundreds of thousands of additional children and families.

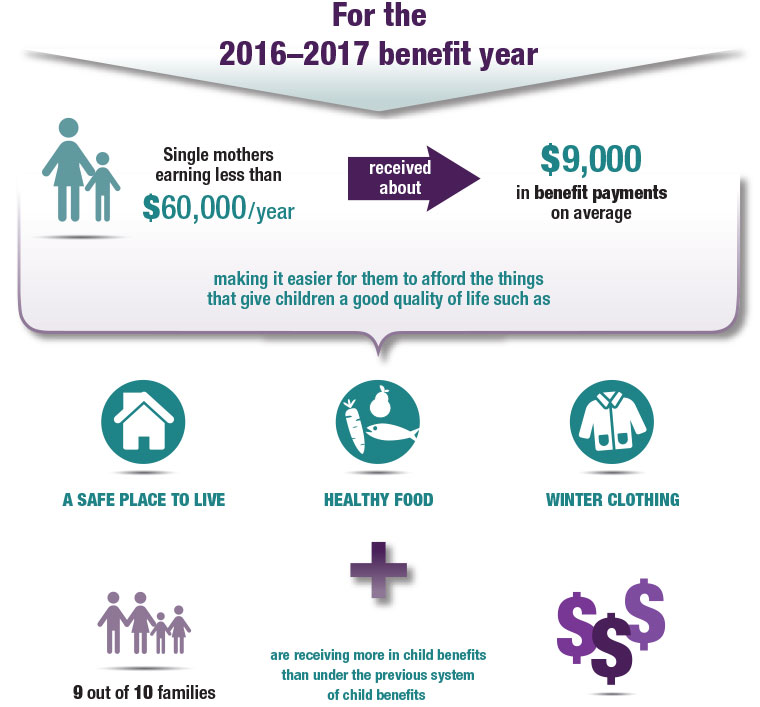

Text description

For the 2016–17 benefit year, single mothers earning less than $60,000 a year received about $9,000 in benefit payments on average, making it easier for them to afford the things that give children a good quality of life, such as a safe place to live, healthy food and winter clothing. In addition, 9 out of 10 families are receiving more in child benefits than under the previous system of child benefits.

Increases in child benefits provide a larger source of income for families with children.

In the 2016-17 benefit year, over 3.3 million families received more than $23 billion in Canada Child Benefit payments, and the nine out of ten families who are better off as a result of the Benefit received on average almost $2,300 more in benefits, tax-free, than under the previous system of child benefits.

As of July 20, 2018, the Canada Child Benefit is indexed to inflation to ensure that the Benefit keeps pace with the cost of living and continues to help Canadian families over the long term. For a single parent of two children earning $35,000 per year, a strengthened Canada Child Benefit will contribute an additional $560 in the 2019-2020 benefit year towards the cost of raising their children.

In 2016, Canada Child Benefit take up for First Nations people living on reserve was nearly 80%, compared to over 95% for Canada.

To address this gap, the Government is improving access to the Canada Child Benefit and other benefits through tailored, in-person service support for Indigenous peoples—in particular in remote and northern communities where there are distinct barriers to accessing federal benefits.

Extra support at this crucial stage of life helps children and families meet their basic needs. It also helps low- and modest-income families join the middle class, and helps keep middle-class families out of poverty should they face a setback.

It is equally important for Canada's seniors to be able to rely on a strong support system in their retirement after many years of hard work. The introduction of the Old Age Security pension and the Guaranteed Income Supplement in 1967 significantly reduced poverty amongst seniors, and the Government has continued to strengthen it. Restoring the age of eligibility from 67 to 65 for the Old Age Security pension and the Guaranteed Income Supplement has helped 100,000 seniors aged 65 and 66 avoid plunging into severe poverty each year. To help seniors who are living in poverty or are most at risk of living in poverty, most of whom are women, the Government also increased the Guaranteed Income Supplement for the lowest-income single seniors. This increase of up to $947 annually is helping improve the financial security of 900,000 seniors, and is lifting 57,000 seniors out of poverty. This measure represents an investment of over $670 million per year.

The Government also continues to make improvements in the delivery of Old Age Security and the Guaranteed Income Supplement so that more seniors get the benefits to which they are entitled. This includes automatically enrolling many new beneficiaries, simplifying the application form and actively reaching out to ensure that qualified seniors receive their benefits. These and other actions have resulted in more than 95,000 additional seniors receiving or about to receive the Guaranteed Income Supplement. This is an added boost for low-income seniors who need the support the most.

Beyond benefits for Canada's seniors, the Government is also working to ensure that Canadians, and particularly those in lower income, are able to access the benefits to which they are entitled. Through the Community Volunteer Income Tax Program, community organizations host free tax preparation clinics to help individuals access the benefits and credits to which they are entitled, including the Canada Child Benefit. In Budget 2018, the Government doubled the size of the Community Volunteer Income Tax Program to a total annual ongoing investment of $13 million, beginning in 2018–19. This investment will also complement the work the Government is undertaking to increase take-up of the Canada Child Benefit among Indigenous peoples.

| Initiative | Children Lifted out of Poverty (LICO) (% reduction) | Persons Lifted out of poverty (LICO) (% reduction) | Children Lifted out of Poverty (Canada's Official Poverty Line) (% reduction) | Persons Lifted out of Poverty (Canada's Official Poverty Line) (% reduction) |

|---|---|---|---|---|

| Canada Child Benefit (2016) | 293,000 39.2% | 497,000 14.8% | 281,000 28.9% | 521,000 12.5% |

| Guaranteed Income Supplement (2016) | Not Applicable* | 13,000 0.4% | Not Applicable* | 57,000 1.3% |

| Canada Workers Benefit (2019) | Not Applicable** | Not Applicable** | 21,000 2.3% | 74,000 1.7% |

| Total Lifted Out of Poverty | 293,000 | 510,000 | 302,000 | 652,000 |

Note:

In general, these poverty reduction impacts do not include populations in Canada's territories and First Nations people living on reserve. One exception, however, is the LICO (Low Income Cut-offs) estimate of poverty reduction impacts of the Canada Child Benefit. Because of statistical modeling limitations, the Government has been using LICO to measure poverty reduction impacts. More recently, the Government has used Canada's Official Poverty Line to measure poverty reduction impacts, such as the impact of the new Canada Workers Benefit. Going forward, the Government intends to use Canada's Official Poverty Line, consistent with the overall plan in Opportunity for All, to measure poverty reduction impacts.

*The Guaranteed Income Supplement is for seniors, and the increase to the benefit's top-up was targeted to single seniors.

** LICO impacts of the Canada Workers Benefit would not take into account the increase to Canada Pension Plan contributions that would take place concurrently to the increase to the Canada Workers Benefit. This is due to the fact that payroll taxes are not subtracted from total income to calculate after-tax income (the income concept used for LICO). Therefore, the poverty reduction impacts calculated using the LICO would not be representative of the true effects of the Canada Workers Benefit on individual incomes.

The Government is also making historic, long-term investment in Canada's first-ever National Housing Strategy, because every Canadian should have a place to call home. With investments of $40 billion over 10 years in housing, the Strategy will help provide Canadians with accessible, affordable housing that meets their needs. Over the next decade, these historic investments in housing aim to reduce or eliminate more than 530,000 families from housing need, protect 385,000 community homes and create another 50,000 units through the expansion of community housing in Canada. The Strategy aims to meet the needs of diverse Canadians, including seniors, Indigenous peoples, survivors of family violence, people with disabilities, refugees, veterans and those grappling with homelessness. The Strategy also commits to ensuring that at least 33% of funds go to projects for women, girls and their families, recognizing the unique vulnerabilities women face in housing. In addition, the Government will support the successful implementation of housing strategies for First Nations, Inuit and Métis.

"While poverty is not always about homelessness, homelessness is always about poverty."

As part of the National Housing Strategy, the Government announced a total investment of $2.1 billion over 10 years to tackle homelessness through an expanded federal homelessness program. A redesigned federal homelessness program, Reaching Home: Canada's Homelessness Strategy, will officially launch on April 1, 2019. The program will bolster community efforts to tackle homelessness, including adopting an outcomes-based approach and enabling communities to gather more comprehensive data on local homeless populations. Together with other National Housing Strategy initiatives, this modernized federal homelessness program aims to reduce chronic homelessness by 50% over the next ten years.

Public infrastructure is crucial in helping Canadians both meet their basic needs and have the opportunity to succeed. That is why the Government has invested in infrastructure that will not just benefit Canadians for years to come, but will also create quality jobs to help Canadians support their families and join the middle class. Investments in public transit will help lower-income Canadians more efficiently and safely navigate busy lives, from getting to work, to bringing a family member to a doctor's appointment, to getting kids to school on time. These investments go beyond just helping Canadians make ends meet; they are helping families spend less time travelling to jobs and school, and more time succeeding in work and education, and being with family members and friends.

The Government's infrastructure investments also support community and cultural spaces. Public spaces like community centres, parks, and libraries can be a valued resource in the lives of lower-income Canadians. Community centres and parks are meeting places where children can play and build friendships that last a lifetime. Libraries offer a breadth of resources to help parents find books to read to their children, apply for jobs and attend information sessions on a variety of topics such as training and nutrition.

Opportunity and inclusion

Tackling poverty means more than providing the bare necessities. It also means promoting opportunity and removing discriminatory barriers based on gender, race, ability, sexual orientation or gender identity and expression that prevent people from getting ahead. The second pillar of Opportunity for All is about helping more Canadians join the middle class by giving every Canadian a real and fair chance to succeed.

For far too long, Indigenous peoples have been held back from reaching their full potential. Generations of Indigenous peoples have suffered from the neglect and failed policies of the federal government. First Nations, Inuit and Métis do not enjoy the same opportunities as other Canadians. It is for these reasons that one of the Government's priorities is to renew the relationship with Indigenous peoples by making real progress on the issues most important to them.

The Government of Canada is committed to reconciliation with Indigenous peoples and to a renewed relationship based on the recognition of rights, respect, cooperation and partnership. No relationship is more important to the Government of Canada than its relationship with Indigenous peoples. As part of its commitment to reconciliation, the Government is working to improve the socio-economic conditions of Indigenous peoples and their communities and bring about transformational change. Since 2015, the Government has invested billions of dollars in health, education, infrastructure, training and other programs that will directly contribute to a better quality of life for Indigenous peoples and a stronger Canada.

As one example, the Government is working with Indigenous partners to design an Indigenous Early Learning and Child Care Framework— one that reflects the unique cultures and needs of First Nations, Inuit and Métis children.

Accessible, inclusive, high quality early learning and child care is critical to giving children the best start in life. The Government has made historical investments of $7.5 billion over 11 years to provide quality, affordable child care across the country. By 2020, up to approximately 40,000 children may benefit from quality new subsidized child care spaces across Canada. This will support parents in the hard work they do for their families by giving them peace of mind with the knowledge that their children are getting the care they need and deserve.

Early years support helps set children on a path to accomplishments in primary and secondary school. And while Canadians know that quality education gives them the tools they need to succeed, many Canadians face multiple challenges that make it difficult to get ahead. Adults may need to re-train for a better job, but post-secondary education may be unaffordable and out of reach. Youth may struggle to complete high school for a variety of reasons, such as having to balance school with a part-time job, or not having a home environment that helps them focus on their studies.

These barriers to post-secondary education hold Canadians back from joining the middle class. To help make college and university more affordable, the Government has increased Canada Student Grants from $2,000 to $3,000 per year for students from lower-income families, from $800 to $1,200 per year for students from middle-income families, and from $1,200 to $1,800 per year for part-time students from lower-income families. This increase is putting more money in the pockets of more than 360,000 full-time and part-time students each year.

The Government has also simplified the Canada Student Loans Program application process and increased the loan repayment threshold by approximately 23%, so that students do not have to repay their loans until they are earning at least $25,000 per year. This increased threshold helps to ease students' transition into the workforce.

In addition, through the new Skills Boost pilot initiative, beginning in fall 2018, adults returning to school on a full-time basis after several years in the workforce will be eligible to receive an additional $1,600 in grant funding per school year, on top of the other grants and loans available to students. Skills Boost will also allow unemployed Canadians to continue receiving Employment Insurance benefits when taking self-funded training.

Pathways to Education Canada is helping youth succeed

Established in 2001, Pathways to Education Canada works with local partners to provide youth from lower-income neighbourhoods with the academic, social and financial supports they need to complete high school. Launched as a pilot project in the Regent Park area of Toronto, the Pathways program has since expanded to 18 communities across Canada.

The Pathways program has proven to be very successful. On average, high school graduation rates increased by 85% in communities offering the Pathways program. Between 2004 and 2015, more than 4,000 Pathways students successfully graduated from high school; nearly three-quarters of these graduates have gone on to pursue post-secondary education or training, further improving their prospects for finding good, well-paying jobs.

In Budget 2017, the Government announced renewed support for Pathways to Education Canada by providing $38 million over four years, starting in 2018 to 2019.

Educational supports for youth and adults help open the gateway into the workplace. As the job market increasingly places a premium on a diverse skill set, Canadians may need to upgrade their skills throughout their careers. On top of the nearly $3 billion per year in current transfers to provinces and territories in support of skills training and employment programs, the Government is ramping up funding to an additional 21% by 2021-22. Transfers have also been made simpler, more flexible and more responsive to the needs of employers and workers, including those currently under-represented in the workforce. Taken together, this funding is helping individuals across all age groups and backgrounds—from youth to more experienced workers, newcomers to Canada, and persons with disabilities and others—so that all Canadians have the opportunity to find and keep quality jobs.

While women's participation in the workplace has increased over the past few decades, there are still less women employed (58%) than men (65%). Women who do work are typically paid less than men for similar work. To address the gender wage gap, the Government will be introducing historic pay equity legislation to ensure that women receive equal pay for work of equal value in federally regulated industries. In addition, the Government will implement pay transparency to make existing wage gaps more evident in federally regulated industries. This will help to highlight employers who lead in equitable pay practices, while holding employers accountable for wage gaps that affect women, Indigenous peoples, persons with disabilities and individuals from racialized communities.

The Government is also taking steps to increase representation of women in male-dominated sectors of the economy, so they too can benefit from good, well-paying jobs. For example, the Government is investing in an Apprenticeship Incentive Grant for Women to encourage women to pursue careers in male-dominated—and better paid—trades, and to ensure that women are increasingly able to model leadership to other aspiring female tradespeople. The Government is also investing in research and data collection to fill important gaps in knowledge as to how to achieve greater diversity and inclusion within the high-paying jobs of tomorrow. One of the first projects the Government will support is an analysis of the unique challenges visible minority and newcomer women face in finding employment in science, technology, engineering and mathematics occupations.

These measures are just a sample of the steps that the Government is taking to reduce gender gaps in education, skills training and employment so all Canadians can have equal opportunity to succeed.

Indigenous peoples are less likely to be employed than non-Indigenous Canadians, and for those who do work, they typically earn less. The Aboriginal Skills and Employment Training Strategy has existed for many years, but funding levels have not kept up with population growth and needs. The Government recognized that more needs to be done to help close the employment and earnings gap between Indigenous peoples and non-Indigenous Canadians. The new Indigenous Skills and Employment Training Program increases funding by 34% compared to the previous program, which will help more Indigenous people gain skills and find jobs to support themselves and their families. The new Program also recognizes the unique needs of First Nations, Inuit and Métis by establishing distinct programmatic and funding streams.

In addition, to ensure that Indigenous students have the same opportunities for success as other Canadian students, in 2017 the Government increased the funding for the Post-Secondary Student Support Program by $90 million over two years. This funding increase will support the post-secondary education and financial needs of more than 4,600 First Nations and Inuit students enrolled in qualifying post-secondary programs.

Newcomers to Canada also face unique barriers to participating fully in their new country, including their ability to enter the workforce. When newcomers are unemployed, or in jobs below their skill level, they can struggle financially and socially, and our economy loses out. To help remove these barriers, the Government is working with provinces and territories to support newcomers' employability, assist Canadian employers to fully benefit from the contribution of newcomers, and streamline and improve foreign qualification recognition.

"I'm from Syria. My husband can't find work. He is a mechanic; he worked as a mechanic for 12 years in Syria. It is more of a hands-on job, but when he applies he is told that he needs a Canadian certificate. I worked for 13 years repairing eyeglasses, and I wish I could do that job here."

In addition, in 2017, the Government launched the Targeted Employment Strategy for Newcomers to help newcomers find jobs that suit their skills and experience. This includes the Foreign Credential Recognition Loans Program, which provides newcomers with loans to help cover credential recognition costs, such as licensing exams. A new three-year Visible Minority Newcomer Women Pilot is beginning in 2018 to 2019 to support programming for newcomer women who are also members of racialized communities.

The Government's plan for reducing poverty must also address systemic barriers such as racism and discrimination that hold some Canadians back. It is unacceptable that any Canadian should face these barriers, and the Government strongly believes that all Canadians should be treated equally and with respect.

In November 2016, the Government appointed a special advisor on LGBTQ2 issues. This advisor is working with LGBTQ2 organizations from across the country to protect the rights of their members, and address discrimination against them—both historic and current. This builds on historic legislation (Bill C-16 passed into law in June 2017) which recognized and reduced the vulnerability of transgender and other gender-diverse persons to discrimination, hate propaganda and hate crimes, and to affirm their equal status in Canadian society.

To help address systemic barriers of racism, the Government will launch cross-country consultations on a new national anti-racism approach. The plan will bring together experts, community organizations, citizens, and interfaith leaders to find new ways to collaborate and combat discrimination, and will increase funds to address racism and discrimination targeted against Indigenous peoples, as well as Indigenous and racialized women and girls.

In particular, as a first step toward recognizing the significant and unique challenges faced by Black Canadians, the Government will also fund local community supports for at-risk youth, and develop research in support of more culturally-focused mental health programs in the Black Canadian community.

The Government is also focused on removing barriers to inclusion for persons with disabilities. Canadians living with disabilities deserve a better chance to succeed in their local communities and workplaces. In June 2018, the Government introduced the Accessible Canada Act in Parliament with the objective to promote equality of opportunity by helping remove barriers and prevent new barriers from being created for persons with disabilities in the federal jurisdiction.

Every Canadian should have a real and fair chance to succeed. Whether a teenager is moving from high school to post-secondary education, or an adult is looking to improve their skills for the next job, or a parent is re-entering the workforce after caregiving leave, or an individual faces discrimination because of their sexual orientation, gender identity and expression, or the colour of their skin, these measures are helping remove barriers and level the playing field so that all Canadians can reach their full potential.

Resilience and security

The third pillar of Opportunity for All is about enhancing income security supports to promote Canadians' capacity to handle life's risks and challenges and develop confidence in the future, while preventing them from falling into poverty by helping them through difficult times.

Canadians who face setbacks or are taking time to care for their families can get the help they need from temporary income support through Employment Insurance (EI). The Government has made a series of EI changes to make the system more flexible, so that people receive their benefits sooner, eligible caregivers can receive a new EI benefit when temporarily taking time away from work to care for critically ill or injured family members, youth and newcomers to Canada have better access to EI benefits, and people who accept some work while receiving EI can keep some of their benefits.

In situations where certain regions or industries are facing hard times—for example, during the downturn of the oil industry in 2015 or the softwood lumber tariffs in 2017—the Government has expanded the flexibility of EI benefits to prevent Canadians from falling into poverty. The Government has also extended support to seasonal workers who exhaust their EI benefits, and has announced that it will increase the maximum EI benefit payment duration from four weeks to seven weeks for workers who are owed wages, vacation, severance, or termination pay when their employer files for bankruptcy or enters receivership.

Canada is a country where everyone has a real and fair chance at success. This means that parents should have the supports they need to balance family and work responsibilities, and be resilient through life changes. That is why the Government proposed a new EI Parental Sharing benefit to promote more equal distribution of family responsibilities between spouses.

Some Canadians struggle more than others, even with a job. There are over 1 million Canadians who are working hard but are still living in poverty. Thanks to the Canada Workers Benefit, beginning in 2019, these lower-income Canadians will get an added financial boost to the money they take home from work. The Government will also make it easier to get the Canada Workers Benefit by ensuring that every worker who qualifies is automatically enrolled in the benefit without having to apply—a major step in fulfilling the Government's commitment of making sure that all Canadians receive the tax benefits and credits to which they are entitled. In addition, the Government is also working to improve the delivery of the Canada Workers Benefit to provide better support to lower-income Canadians throughout the year, rather than through an annual refund when they file their taxes.

The Canada Workers Benefit will help Canadians who work but still struggle

Because of the Canada Workers Benefit, a lower-income worker earning $15,000 a year could receive up to nearly $500 more from the program in 2019 than they received in 2018. That is as much as $1,100 to handle unexpected costs and help plan for the future. Overall, the introduction of the Canada Workers Benefit will lift approximately 70,000 Canadians out of poverty.

Getting a job is important, but working conditions for employees are equally important. The Government is demonstrating leadership through the Canada Labour Code to give workers in federally-regulated private sectors improved work-life balance, such as the right to request flexible work arrangements from their employer. This added flexibility will help workers better manage work, family and personal responsibilities, which can always be a challenge in the busy lives of Canadians. A broader review of Part III (Federal Labour Standards) of the Canada Labour Code will ensure that Canadians can continue to benefit from a robust set of federal labour standards that respond to the realities of today's workplaces and set the stage for good-quality jobs. As a part of this review, between May 2017 and March 2018, the Minister of Employment, Workforce Development and Labour held consultations with Canadians, unions and labour organizations, employers and employer organizations, academics, other experts and advocacy groups to get their perspectives on what a robust and modern set of federal labour standards should look like.

The Government has also taken steps to help Canadians be more resilient in retirement. Specifically, the Government reached a historic agreement with provinces to enhance the Canada Pension Plan (CPP) to help Canadians achieve safe, secure and dignified retirements. The CPP enhancement will increase the maximum CPP retirement benefit by 50% over time (from over $13,000 per year to nearly $21,000 per year if it was in place today). The increase is based on higher CPP replacement earnings in retirement and increasing the range of earnings covered by the CPP. The CPP enhancement will also include an increase to the maximum disability benefit. The enhanced CPP will continue to be indexed annually to keep up with the cost of living, and will be fully portable across jobs and provinces. It will provide financial stability so Canadians can worry less about outliving their savings in retirement.

Nothing is more important to us than our health. An unexpected illness or the onset of a disability or chronic health condition—even an accident—can devastate a family who may have been doing well until then. Illness can result in individuals no longer being able to work through no fault of their own. To aggravate the matter, there may be high costs for prescription drugs or other treatments, as well as transportation costs for getting to appointments.

Canadians can be rightfully proud of having a universal health care system that helps guard against these risks and impacts. The Government has taken leadership in engaging with provinces and territories to address key health care priorities and keep our health care system strong. In particular, this includes investments of $11 billion over 10 years to provinces and territories specifically targeted to improve home care and mental health services. The Government has also allocated $544 million over five years to federal and pan-Canadian health organizations to support health innovation and pharmaceutical initiatives.

Beyond these measures, the Government is taking action to address the serious impacts that the opioid crisis is having on communities across Canada. This public health crisis affects people of all ages and backgrounds, in all regions of the country, from inner cities, to the suburbs, to rural and remote communities and Indigenous communities. Opioid-related overdoses and deaths are devastating communities. Investments of $231.4 million over five years beginning in 2018–19 will improve access to evidence-based treatment services for those in need.

Taken together, the Government has made these investments because it recognizes how crucial it is for Canadians to know that we have supports there when we need them so that we can all bounce back.

Investing in the social and economic fabric of Canada

All of these initiatives will reduce poverty—and they are just a sample of the many measures that the Government has taken to improve Canada's social infrastructure so that all Canadians have the social and economic supports needed to thrive as part of the middle class.

To learn more about these investments, please refer to Annex 2: Government Initiatives that Support Poverty Reduction at the end of this document. These measures are there for Canadians because we are all better off when no one is left behind, and all Canadians should be able share in our collective prosperity.

Chapter 3: Dignity

There are some things that no Canadian should go without, and some choices that should not have to be made. Everyone should have a nutritious and healthy diet, accessible and affordable housing, essential health care needs met, and enough money to avoid making hard choices between these and other things that are an essential part of life in their communities—between paying the rent and feeding the kids, between filling a prescription and keeping the heat on in the winter.

The first pillar of Opportunity for All gives priority to those most in need, and seeks to eliminate deprivation of basic necessities. Research and experience tell us that poverty as it relates to these basic necessities is not only about money but also about access to suitable housing, healthy and nutritious food, and health care, and it requires action from communities, local governments, and provincial and territorial authorities.

"There is just not enough money and my bills equal more than my income. It causes tough choices. You want to buy things for your kids but rent takes priority."

Measuring progress in helping Canadians meet their basic needs

In addition to measuring poverty using Canada's Official Poverty Line, Opportunity for All will track, as part of a dashboard of indicators, four elements that all Canadians need, regardless of where they live: food, housing and shelter, health care, and a basic level of income. Statistics Canada surveys and other sources will be used to guide and monitor progress in helping Canadians meet their basic needs.

Progress will be achieved if more Canadians are able to afford healthy and nutritious food, and live in housing that is in good condition and of suitable size for their families, and if the number of Canadians who are chronically homeless decreases. Progress will also mean that more Canadians are able to receive health care when they need it. Finally, progress will mean that the income of the poorest of the poor has also risen, so that more Canadians are closer to meeting their basic needs and the modest standard of living reflected in Canada's Official Poverty Line.

These indicators will allow all Canadians to monitor how well we are doing at working together to reduce poverty. These indicators will be detailed enough to track progress not just at the national level, but also at the provincial and territorial level, and for various groups of Canadians defined by gender, age, family composition, Indigenous identity, disability status, and other personal and social characteristics. For example, the indicators could be used to track progress for Black Canadians and other racialized communities, as well as for other groups.

"There is a perception of what you can't have if you are poor; that dehumanizes people."

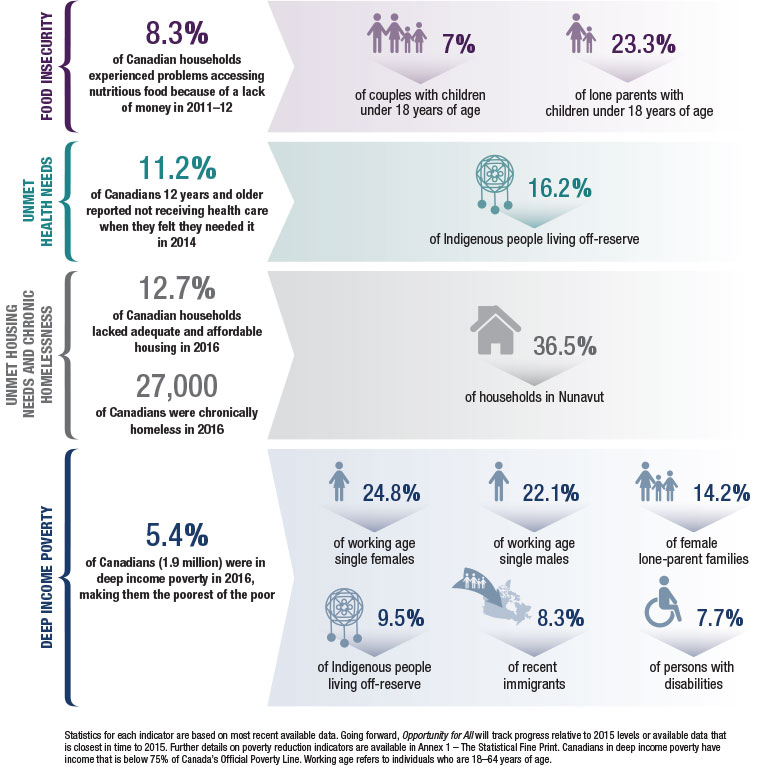

Text description

Food insecurity:

- 8.3% of Canadian households experienced problems accessing nutritious food because of a lack of money in 2011–12.

- 7% of couples with children under 18 years of age

- 23.3% of lone parents with children under 18 years of age

Unmet health needs:

- 11.2% of Canadians 12 years and older reported not receiving health care when they felt they needed it in 2014

- 16.2% of Indigenous people living off-reserve

Unmet housing needs and chronic homelessness:

- 12.7% of Canadian households lacked adequate and affordable housing in 2016.

- 27,000 Canadians were chronically homeless in 2016.

- 36.5% of households in Nunavut

Deep income poverty:

- 5.4% of Canadians (1.9 million) were in deep income poverty in 2016, making them the poorest of the poor.

- 24.8% of working age single females

- 22.1% of working age single males

- 14.2% of female lone-parent families

- 9.5% of Indigenous people living off-reserve

- 8.3% of recent immigrants

- 7.7% of persons with disabilities

Statistics for each indicator are based on most recent available data. Going forward, Opportunity for All will track progress relative to 2015 levels or available data that is closest in time to 2015. Further details on poverty reduction indicators are available in Annex 1 – The Statistical Fine Print. Canadians in deep income poverty have income that is below 75% of Canada's Official Poverty Line. Working age refers to individuals who are 18 to 64 years of age.

Chapter 4: Opportunity and inclusion

Addressing poverty is about more than just providing the bare necessities of life. Many Canadians struggle to get ahead because of barriers beyond their control, such as discrimination or unacceptable prejudices. For example, Black Canadians and people from other racialized communities can face discrimination that prevents them from getting a good job despite being qualified, or from advancing in their career. Discrimination based on skin colour can also lead to social exclusion, whether in the workplace or in the community.

Indigenous peoples often face long-standing challenges rooted in Canada's colonial history, which has marginalized generations and led to poverty. Discrimination can also be based on other factors, such as a person's sexual orientation or gender identity and expression. As well, persons with disabilities do not have the same level of opportunity and inclusion as other Canadians when physical spaces are simply not accessible to them. Newcomers to Canada often face multiple challenges, such as learning a new language and finding work, as they try to advance. Challenges can be particularly severe when these attributes intersect: for example, for a Black Canadian woman with a disability.

Accordingly, a fundamental part of addressing poverty is to promote community and opportunity, and to remove discrimination based on gender, race, disabilities, sexual orientation or other grounds, and other roadblocks that prevent people from getting ahead.

The second pillar of Opportunity for All is aligned with the right to equality and non-discrimination under domestic law. This pillar is about fostering opportunity and movement out of poverty so that more Canadians can join the middle class and fully participate in their communities. It is about making it easier for Canadians to move up the income ladder, climb out of poverty and feel empowered through self-sufficiency.

Promoting opportunity means removing barriers and helping all Canadians excel through access to life-long education and skills development, which lead to quality jobs. These essential skills include literacy and numeracy among all Canadians, but particularly among young people, with their engagement in employment, education and training continually on the rise.

Initiatives undertaken by the Government mean Canadians will increasingly have enough income to afford not just the basic necessities, but also the other things they need to fully participate in their communities.

For many Canadians, particularly those working hard to join the middle class, this is a vision to promote engagement and social inclusion so we can thrive together, and have the support of our family, friends and everyone in our communities. Working together we can ensure that no one is left behind. This is a vision to promote full participation of all Canadians in our society.

"Once you're stuck below the poverty line, it is so hard to get above it."

"Poverty is not an equal opportunity disabler—gender, race, and other factors bear heavily and need to be acknowledged in designing responses."

Measuring progress in helping Canadians join the middle class

Canada's Official Poverty Line is sensitive to the reality of being able to afford the necessities of life, reflecting the costs of a healthy basket of food, appropriate shelter and home maintenance, clothing and transportation. But it is also sensitive to the reality of being able to afford other things that permit full engagement in the community, such as the extra-curricular activities that round out a child's life.

However, social inclusion and equality of opportunity cannot be measured simply in dollars, as there are some necessities we all require to reach our full potential. That is why the Opportunity Pillar includes four indicators to measure the skills and level of engagement that are required to increase the odds that Canadians will lead fulfilling lives.

In a world where technology is increasingly part of all aspects of our life, more than ever, all Canadians need to be able to read, write, and perform basic math to be able to participate in their communities. Young people should be actively engaged, whether in employment, education or training. Adults should be supported in pursuing life-long learning, gaining new skills and strengthening existing skills. Persons with disabilities should be able to participate in their communities.

The distance between Canadians in poverty and those in the middle class, as measured by relative low income, should be reduced so that more Canadians can see getting out of poverty as a realistic possibility. And finally, the share of total income earned by Canadians in the lower 40% of the income distribution should increase, which is consistent with the United Nations Sustainable Development Goals of reducing inequalities within countries.

Progress on these measures will be achieved if the number of Canadians equipped with literacy and numeracy skills rises, as these basic skills are critical for having quality jobs and participating in many aspects of life. Progress will mean there are more young people in jobs, education or training, so they can share in our collective prosperity. Finally, progress will mean that the number of Canadians with less than half the income of the typical Canadian decreases while the share of income earned by Canadians in the lower 40% of the income distribution increases, with more Canadians joining the middle class. These results would be distributed evenly, reflecting equitable opportunities and ensuring that all Canadians are able to benefit, regardless of gender, race, ethnicity, sexual identity and expression, or ability.

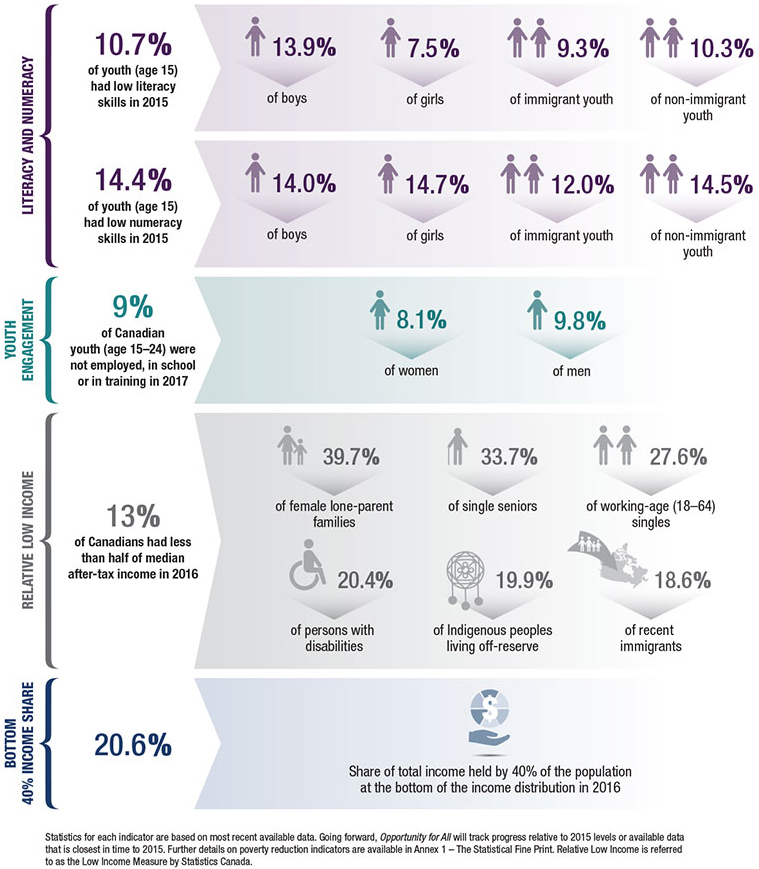

Text description

Literacy and numeracy:

- 10.7% of youth (age 15) had low literacy skills in 2015.

- 13.9% of boys

- 7.5% of girls

- 9.3% of immigrant youth

- 10.3% of non-immigrant youth

- 14.4% of youth (age 15) had low numeracy skills in 2015.

- 14.0% of boys

- 14.7% of girls

- 12.0% immigrant youth

- 14.5% of non-immigrant youth

Youth engagement:

9% of Canadian youth (age 15 to 24) were not employed, in school or in training in 2017.

- 8.1% of women

- 9.8% of men

Relative low income:

- 13% of Canadians had less than half of median after-tax income in 2016.

- 39.7% of female lone-parent families

- 33.7% of single seniors

- 27.6% of working-age (18 to 64) singles

- 20.4% of persons with disabilities

- 19.9% of Indigenous peoples living off-reserve

- 18.6% of recent immigrants

Bottom 40% income share:

- 20.6% Share of total income held by 40% of the population at the bottom of the income distribution in 2016.

Statistics for each indicator are based on most recent available data. Going forward, Opportunity for All will track progress relative to 2015 levels or available data that is closest in time to 2015. Further details on poverty reduction indicators are available in Annex 1 – The Statistical Fine Print. Relative Low Income is referred to as the Low Income Measure by Statistics Canada.

Chapter 5: Resilience and security

Canadians should have the income security and social supports they need to be able to rebound from life's setbacks. Canadians have told us about their stresses when dealing with life's uncertainties. These stresses include falling ill and being unable to work; losing a good job after many years of loyal service; leaving work to care for a child with a disability or a sick parent; experiencing divorce, separation, or widowhood which have a disproportionately negative economic impact on women; or funding a secure and dignified retirement.

We all experience setbacks in life. During these difficult times, many of us can seek help from family and friends. Parents can sometimes ask their neighbours to look after their kids for the afternoon while they visit a sick relative in hospital. A brother or sister can often offer help with finding a new job. Unfortunately, not all Canadians have access to these supports when they need them. Together, we can all help each other through challenging times.

The third pillar of Opportunity for All is about promoting the capacity to handle life's risks and challenges, and developing confidence in the future. It is about preventing people from falling into poverty wherever they are on the income ladder, particularly those who have experienced poverty in the past and have worked hard to move up, but also those who have long been in the middle class. At its core, the best protection against poverty is having a job. However, when Canadians struggle with finding employment or cannot work due to disability or illness, we all need to step up and help.

"[Escaping poverty means] the ability to LIVE, not just survive."

"[Success in poverty reduction would mean] an increase in hopefulness and a decrease in helplessness."

Measuring progress in helping Canadians remain resilient through growth that benefits everyone

Supporting a resilient middle class requires economic growth that increases the incomes of individuals in poverty as well as the majority of the population. In this way, Opportunity for All is an integral part of fostering a strong middle class.

Opportunity for All will track progress on four inter-related indicators of resilience in Canadian households: the hourly wage rate earned by the average Canadian, the percentage of Canadians that fall into poverty each year as well as the percentage of Canadians that are lifted out of poverty each year, the average shortfall below the poverty line among those who are below Canada's Official Poverty Line, and the number of Canadians with sufficient savings and other assets to handle a setback without falling into poverty.

"Liquid assets provide a cushion against life's emergencies, help low-income families to smooth month-to-month income/expense gaps when incomes are volatile, and reduce the need to turn to costly, high-risk loans to make ends meet."

Progress will be achieved if wages paid rise, and the percentage of Canadians falling into poverty each year decreases while the number of Canadians being lifted out of poverty each year increases. On average, Canadians living in poverty earn $9,000 less than Canada's Official Poverty Line. Therefore, progress will mean that Canadians living in poverty will see their incomes increase and move closer to the poverty line. Finally, progress will be achieved if more Canadian families are able to handle unexpected expenses, or reduced income, and face the future with more security and confidence.

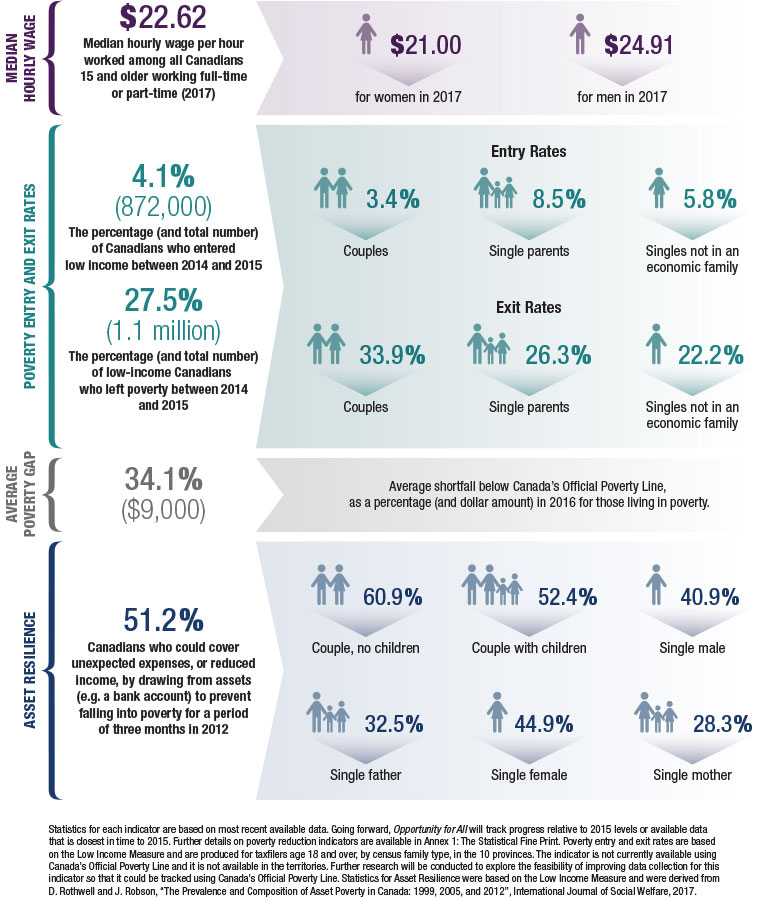

Text description

Median hourly wage

- $22.62: Median hourly wage per hour worked among all Canadians 15 and older working full-time or part-time (2017).

- $21.00 for women in 2017

- $24.91 for men in 2017

Poverty entry and exit rates

- 4.1% (872,000): The percentage (and total number) of Canadian taxfilers who entered low income between 2014 and 2015.

- 27.5% (1.1 million): The percentage (and total number) of low-income Canadian taxfilers who left poverty between 2014 and 2015.

- Entry rates

- 3.4%: couples

- 8.5%: single parents

- 5.8%: singles not in an economic family

- Exit rates

- 33.9%: couples

- 26.3%: single parents

- 22.2%: singles not in an economic family

Average poverty gap

- 34.1 % ($9 000): Average shortfall below Canada's Official Poverty Line, as a percentage (and dollar amount) in 2016

Asset resilience

- 51.2% Canadians who could cover unexpected expenses, or reduced income, by drawing from assets (for example, a bank account) to prevent falling into poverty for a period of three months in 2012.

- 60.9%: couple, no children

- 52.4%: couple with children

- 40.9%: single male

- 32.5%: single father

- 44.9%: single female

- 28.3%: single mother

Statistics for each indicator are based on most recent available data. Going forward, Opportunity for All will track progress relative to 2015 levels or available data that is closest in time to 2015. Further details on poverty reduction indicators are available in Annex 1: The Statistical Fine Print.

Poverty entry and exit rates are based on the Low Income Measure and are produced for tax-filers age 18 and over, by census family type, in the 10 provinces. The indicator is not currently available using Canada's Official Poverty Line and it is not available in the territories. Further research will be conducted to explore the feasibility of improving data collection for this indicator so that it could be tracked using Canada's Official Poverty Line. Statistics for Asset Resilience were based on the Low Income Measure and were derived from D. Rothwell and J. Robson, "The Prevalence and Composition of Asset Poverty in Canada: 1999, 2005, and 2012", International Journal of Social Welfare, 2017.

Chapter 6: Working with provinces, territories and communities

While Opportunity for All is a federal initiative, the Government of Canada knows that, to be successful, it cannot act alone. Partnerships are essential to implementing a poverty reduction strategy that works for all Canadians.

The Government recognizes the work accomplished by all the provinces and territories, all of which have poverty reduction strategies in place or in development. Provinces and territories have taken leadership roles and charted a way forward with poverty reduction strategies and initiatives, as have many communities across the country.

On July 31, 2018, provincial and territorial Ministers released a joint statement on poverty reduction entitled, "Meeting the Challenge: Provincial-Territorial Vision Statement on Poverty Reduction." The Statement aligns well with Opportunity for All and can be seen in full on the next page. For example, the Statement includes a vision of all Canadians having the opportunity to live with dignity and reach their full potential; emphasizes collaboration to address social and economic challenges that cross levels of government; focuses on poverty reduction, prevention and alleviation; and highlights the importance of listening and incorporating views and perspectives of individuals with lived experience of poverty.

Moving forward in the service of all Canadians will require efforts that are aligned and complementary across orders of government, where feasible. This helps ensure that Canadians do not miss out on benefits to which they are entitled, or face gaps or duplication in government programming. It also ensures that interactions between federal and provincial or territorial programs do not have unintended consequences that adversely affect individuals and families. Alignment across the different orders of government will also ensure that communities throughout Canada will be well-positioned to help individuals move out of poverty.